Even during these uncertain times, organizations must develop and adjust their strategy to ensure they continue to grow. This session includes Mark Roberts (CEO of TechServe Alliance) sharing a great range of industry-wide insights and stats that illustrates strategies for Engineering & IT staffing growth.

Watch the Replay

Presenter: Mark Roberts (CEO, TechServe Alliance)

How to Drive Engineering & IT Staffing Growth

For two decades, TechServe Alliance has tracked the net profit for staffing firms. And for two decades, this profit has hovered around the same number: 4%. In 2019, it was 3.9%. In 2020, it may be lower, due to the COVID-19 pandemic. But no matter the variance, the data is clear: staffing is a low-margin business.

But that doesn’t mean staffing firms can’t increase profitability. It just means they have to be smart about it. In fact, TechServe Alliance has found that if staffing firms can cut their gross margin by 1%, that will yield an increase in bottom-line profit of 26%.

So how can staffing firms become more profitable? As an authority on staffing firms, TechServe Alliance has a few suggestions.

Steps to Engineering & IT Staffing Growth

Generally speaking, there are three ways for firms to become more profitable:

- Place More Consultants

- Boost Productivity for Sales & Recruitment

- Manage for Higher Gross Margins

TechServe Alliance has found that high-profit firms concentrate their efforts on these three categories—with great results. The only question is, how to observe these different steps?

Placing More Consultants

Placing more consultants is the most obvious way staffing firms can increase profitability. Unfortunately, it’s easier said than done. In light of COVID-19, talent supply now far exceeds talent demand, rendering placements all the more difficult to land.

That said, there are ways staffing firms can set themselves up for success. By diving into precise metrics on unemployment per industry and per role, staffing firms can give themselves leverage in negotiations with clients, placing consultants at higher rates.

For example, TechServe Alliance’s IT & Engineering Employment Index did find that unemployment rose for engineers & IT professionals. But compared to the overall unemployment rate, engineers & IT professionals were generally well employed. In fact, at the end of Q2 in 2020, general unemployment ranked ta 13%. But Engineering & IT staffing growth was only 5.7% and 3.3% respectively (for electrical engineers, unemployment was only at 2.4%).

This almost 10% gap indicates IT & Engineering that staffing firms may be in a stronger position than they think. Furnishing your company with this kind of data equips your team with the information they need to negotiate higher placement rates and place more candidates—both key factors in increasing profitability.

Boost Productivity for Sales & Recruiting

But data isn’t the only way to increase profitability. Employee productivity (ill-defined as the term is) can also make a significant difference in your financials.

Let’s take an example. According to TechServe Alliance’s findings, the revenue per salesperson in the 75th percentile of performers is 6x higher than salespeople in the 25th percentile. For staffing firms, then, it’s critical to employ not many salespeople, but successful salespeople to optimize profits.

So how do staffing firms bring their teams up to full productivity? The answer is obvious: train them, and train them well. Unfortunately, most staffing firms can’t afford expert trainers.

That’s why TechServe Alliance recently launched their Sales & Recruiting Management Program. TechServe “rents out” training experts, who then consult with staffing firms and train salespeople & recruiters to maximize productivity. By implementing this disciplined approach to sales & recruiting management, staffing firms are able to quantify their teams’ productivity, and thereby increase their profits.

Manage for Higher Gross Margins

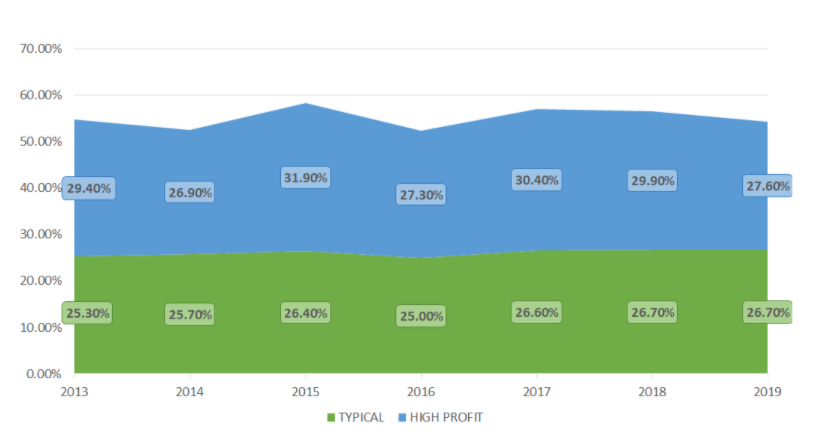

High-earning firms manage their operations tightly, maximizing gross margins. In the below graph, you can see the difference between high-profit gross margin trends and typical gross margin trends for staffing firms.

So how do high-profit staffing firms distinguish themselves? One huge tip is monitoring your submittals by business type. Typically, direct client relationships have a 6% gross margin than MSP submissions. That means that pursuing direct clients is generally a more profitable strategy.

To learn more about TechServe Alliance, and the ways in which the Association helps the staffing industry, visit here.